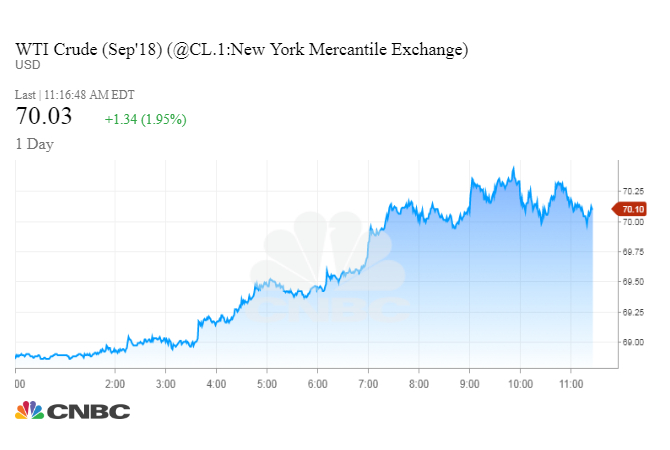

周一油价回升至每桶70美元以上,美国原油在基准价连续四周下跌后,一个多月来一日内涨幅最大。

美国西德克萨斯中质原油周一收盘上涨1.44美元,或2.1%,至每桶70.13美元。虽然合约在过去10个交易日中有7个交易日上涨,但自6月27日以来并没有超过每桶1美元的涨幅。

截至周五,WTI在过去四周下跌超过7%,因为少数交易时段的重大损失摧毁了基准的一系列温和的日收益。

截至美国东部时间下午2:08 ,交付9月国际基准布伦特原油的合约价格上涨83美分,或1.1%,至每桶75.12美元。9月合约将于周二到期。10月合约的交易较为沉重,上涨97美分,或1.3%,报75.73美元。

在也门的胡希叛乱分子袭击红海的一对油轮后,沙特阿拉伯宣布暂停通过关键的Bab el-Mandeb海峡的石油运输,价格获得支撑。沙特阿拉伯领导了一个军事联盟,反对与伊朗统一的胡图人超过三年。

欧亚集团的风险咨询公司表示,对油轮的袭击“代表了也门冲突周围动态的严重升级。”

欧洲集团中东和北非负责人艾哈姆•卡梅尔(Ayham Kamel)表示,虽然胡希叛乱分子可能长期以来一直有能力威胁巴西 - 曼达姆海峡的沙特石油运输,但他们愿意使用它是该地区紧张局势升级的结果。实践在一份研究报告中说,使用替代拼写为海峡。

“伊朗领导人可能鼓励袭击事件向美国,沙特阿拉伯和以色列证明伊朗及其盟国有能力应对日益加剧的经济,政治和军事压力。”

美国和伊朗最近进行了一场口水战,伊朗官员威胁要在这个世界上最繁忙的原油运输地区遏制石油出口。在下周两个截止日期的第一个截止日期之前,国际企业在重新受到美国制裁的情况下放松与伊朗的关系,紧张局势正在上升。

这种情况引发了对世界缺油问题的担忧。

随着加拿大Suncor Energy公司全面恢复其大规模的Syncrude油砂厂的运营,这些担忧得到了扩大,今年早些时候停电供应中断了供应。该公司已经缩减了今年Syncrude对生产的预期,并且有报道称该设施可能无法尽早完全投入运营。

能源对冲基金Again Capital的创始合伙人John Kilduff表示,“这只是从伊朗到Syncrude的女性支持因素。”

对冲基金和基金经理在能源商品方面变得更具建设性。路透社的一项分析显示,基金最近一周增加了对布伦特,美国汽油,美国取暖油和欧洲汽油的看涨押注。

虽然基金削减了对WTI的看涨押注,但美国原油价格下跌的投注数仍然低迷。

路透社的一项调查显示,欧佩克15个成员国的石油卡特尔7月份日产量增加了7万桶。这将标志着6月份产量增长放缓,当时该集团的产量增加了173,000桶/天。欧佩克正在寻求向市场增加供应,以防止价格过快上涨和抑制需求。

唐纳德特朗普总统与欧盟委员会主席让 - 克洛德·容克尔在上周的贸易争端中取得进展后,对石油需求强劲降温的担忧有所缓解。

然而,美国和中国之间不断升级的贸易战继续威胁经济增长前景,这将对石油消费造成压力。

原文

Oil prices rose back above $70 a barrel on Monday, with U.S. crude posting its best one-day dollar gain in over a month, after four weeks of losses for the benchmark.

U.S. West Texas Intermediate crude ended Monday's session up $1.44, or 2.1 percent, to $70.13 a barrel. While the contract has risen in seven of the last previous 10 sessions, it has not posted a gain of more than $1 a barrel since June 27.

As of Friday, WTI was down more than 7 percent over the last four weeks, as heavy losses in a handful of trading sessions wiped out a string of modest daily gains for the benchmark.

The contract to deliver international benchmark Brent crude for September was up 83 cents, or 1.1 percent, at $75.12 a barrel by 2:08 p.m. ET. The September contract expires on Tuesday. Trading was heavier for the October contract, which is up 97 cents, or 1.3 percent, at $75.73.

Prices got support after Saudi Arabia announced it would suspend shipments of oil through the critical Bab el-Mandeb Strait, after Houthi rebels in Yemen attacked a pair of oil tankers in the Red Sea. The Saudis have led a military coalition against the Iran-aligned Houthis for more than three years.

Risk consultancy the Eurasia Group says the attack on the tankers "represents a serious escalation in dynamics around the Yemen conflict."

"While Houthi rebels probably long possessed the capability to threaten Saudi oil shipments in the Bab-al Mandab Strait, their willingness to use it is the result of rising tensions in the region," Ayham Kamel, head of Eurasia Group's Middle East and North Africa practice said in a research note, using an alternative spelling for the strait.

"The attack was probably encouraged by the Iranian leadership to demonstrate to the US, Saudi Arabia, and Israel that Iran and its allies retain a capacity to respond to intensifying economic, political, and military pressure."

The United States and Iran have lately engaged in a war of words, with Iranian officials threatening to snarl oil exports in the world's busiest region for crude shipments. Tension is rising ahead of the first of two deadlines next week for international businesses to wind down ties with Iran under renewed U.S. sanctions.

The situation raises concerns that the world will be short of oil.

Those concerns have been amplified as Canada's Suncor Energy works to fully restore operations at its massive Syncrude oil sands facility, where supplies have been disrupted by a power outage earlier this year. The company has scaled back its expectations for production from Syncrude this year, and there are reports the facility might not be fully operational as early as expected.

"It's just this witches' brew of supportive factors from Iran to the Syncrude," said John Kilduff, founding partner at energy hedge fund Again Capital.

Hedge funds and money managers are getting more constructive on energy commodities. Funds increased their bullish bets in Brent, U.S. gasoline, U.S. heating oil and European gasoil in the latest week, according to a Reuters analysis.

While the funds trimmed their bullish bets on WTI, the number of wagers that U.S. crude prices will fall remains depressed.

A Reuters survey indicates that the 15-member OPEC oil cartel increased output by 70,000 barrels per day in July. That would mark a slowdown in production growth from June, when the group hiked production by 173,000 bpd. OPEC is seeking to add supplies to the market to prevent prices from rising too quickly and denting demand.

Fears that robust demand for oil will cool off have eased following a meeting between President Donald Trump and European Commission President Jean-Claude Juncker that yielded progress in a trade dispute last week.

However, an escalating trade battle between the United States and China continues to threaten economic growth prospects, which would weigh on oil consumption.

(本文转自汤姆迪克里斯托弗,如有版权问题,请联系小编)